In a world where your credit score can open (or close) doors to opportunities, choosing the right credit building app could be one of the smartest financial decisions you make. Whether you’re just starting out, trying to rebuild after a setback, or simply want better control of your financial future—Self, Kikoff, and Chime are among the most talked-about tools out there.

But which one actually delivers? And more importantly—which one is best for you?

Let’s break it down.

Why Credit Building Apps Matter More Than Ever

For young adults, freelancers, and anyone without traditional credit history, getting access to credit can feel like hitting a brick wall. Lenders want to see a track record—but how do you build that without access?

That’s where credit building apps step in. These tools are designed to report your responsible financial behavior (like timely payments) to credit bureaus, helping improve your score gradually—and often without a hard credit pull.

Apps like Self, Kikoff, and Chime promise similar outcomes, but their methods, features, and costs differ in ways that matter.

Self vs. Kikoff vs. Chime – Quick Comparison

Here’s a snapshot before we dive deeper:

| App | Main Feature | Fees | Credit Bureaus Reported To | Best For |

|---|---|---|---|---|

| Self | Credit-builder loan with savings component | ~$25/month | All three (Experian, Equifax, TransUnion) | Building credit + saving |

| Kikoff | $750 revolving credit line, no interest | $0–$5/month | Equifax, Experian | Super low-cost credit boost |

| Chime | Secured credit card tied to Chime account | No annual fees | All three major bureaus | Existing Chime users |

In-Depth Breakdown

Self – For the Disciplined Saver

How it works:

Self creates a credit-builder loan held in a secured account. You pay it off in monthly installments, and once it’s paid, you get access to the funds.

Key Benefits:

- Reports to all three credit bureaus

- Builds payment history and credit mix

- Helps you build savings while improving credit

Potential Drawbacks:

- Monthly cost may be higher than other apps

- You don’t access the money until the loan is complete

Perfect for: People who want to build credit and discipline their savings habit.

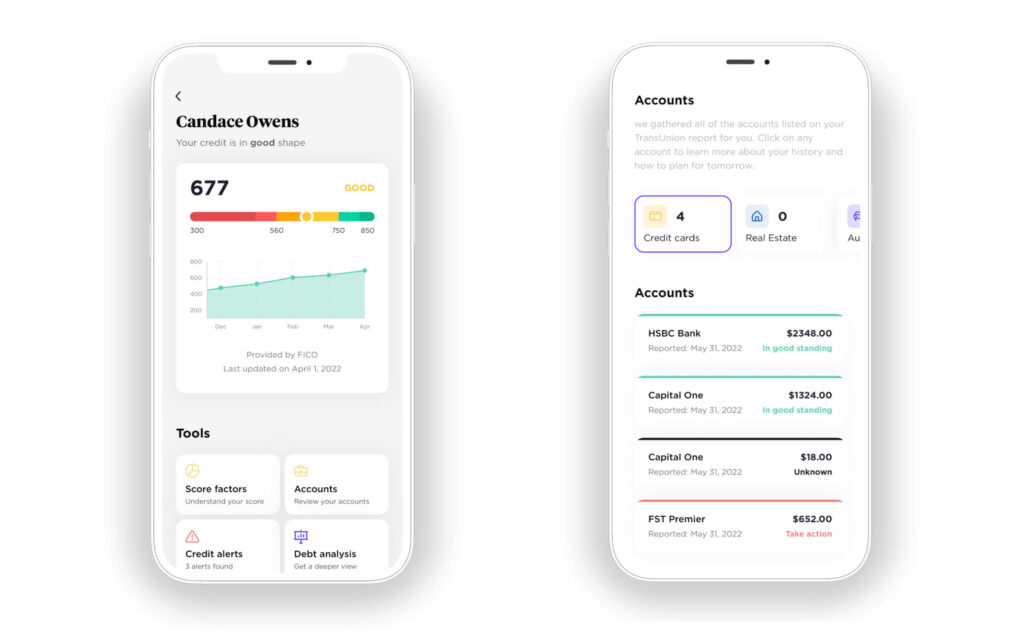

Kikoff – For the Budget-Conscious Beginner

How it works:

Kikoff offers a $750 line of credit that you use to purchase items from their online store (think: ebooks, financial tools). You pay as little as $5/month, and all payments are reported to credit bureaus.

Key Benefits:

- No interest, no hard credit check

- Super low monthly cost

- Starts reporting immediately

Potential Drawbacks:

- Can only use credit in the Kikoff marketplace

- Limited flexibility compared to traditional credit cards

Perfect for: Anyone looking for an ultra-affordable way to build credit fast, especially beginners or students.

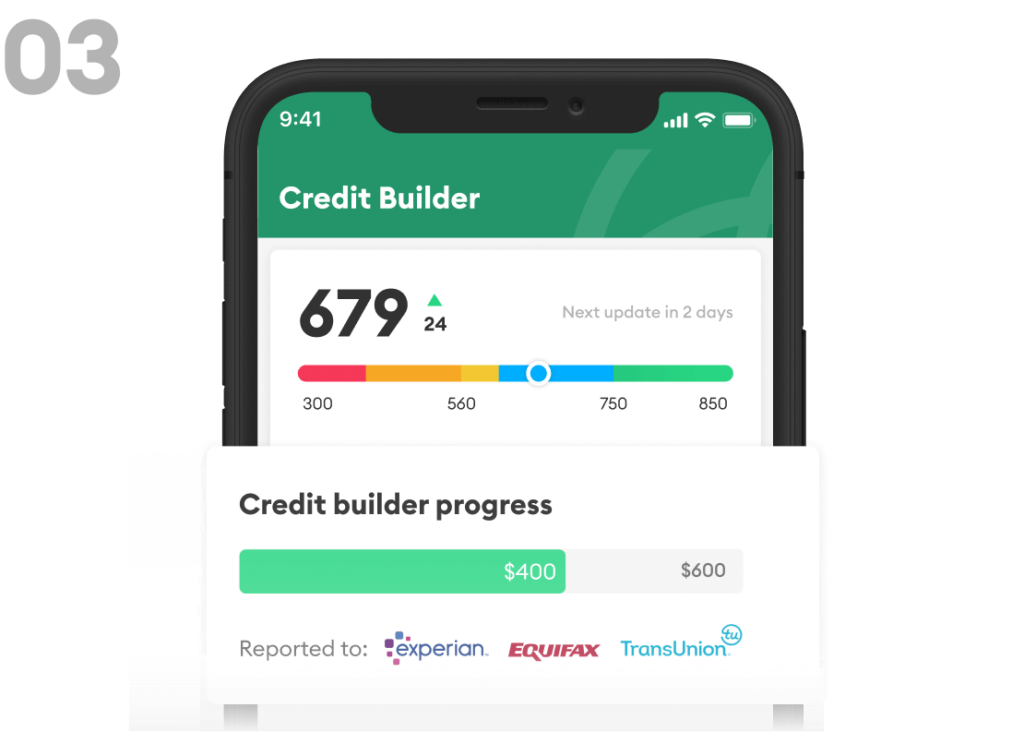

Chime – For Everyday Users Who Already Bank With Chime

How it works:

Chime offers a Secured Credit Builder Visa® Card funded by a Chime Spending Account. You move money into the card and use it like a debit card. Payments are reported as on-time credit usage.

Key Benefits:

- No interest, no annual fees

- No credit check to apply

- Helps reduce credit utilization rate

Potential Drawbacks:

- Must already have a Chime account

- Requires regular transfers to work effectively

Perfect for: People who already use Chime and want a simple, no-fuss way to boost their credit.

Expert Tips for Choosing the Right Credit Building App

- If you want to save and build credit: Go with Self

- If you’re on a tight budget: Try Kikoff

- If you’re a Chime user already: The Chime Credit Builder Card makes the most sense

And regardless of which app you choose, always:

- Make on-time payments

- Monitor your credit score progress monthly

- Avoid opening too many new accounts at once

Related Reading on GetCashVibe:

- Top Investment Alternatives to REITs

- [Best Budgeting Apps for 2025]

- [How to Improve Your Credit Score Without a Credit Card]

FAQs About Credit Building Apps

What is the best app to boost your credit fast?

Kikoff is a top choice for fast, affordable results—especially if you’re just starting.

Can credit building apps hurt your score?

Not if used responsibly. Late payments or closing accounts early can negatively impact your score, but regular usage usually helps.

Is Chime’s credit builder card legit?

Yes. It’s a secured credit card with no interest or fees. It reports to all major bureaus and helps build positive history.

How long does it take to see results?

Most users begin seeing credit score improvements in 3 to 6 months, depending on usage and credit profile.

Conclusion

Choosing the best credit building app isn’t just about features—it’s about fit. Whether you need a low-cost starter tool like Kikoff, a save-as-you-go plan from Self, or a simple secured card through Chime, the right app can put your credit goals within reach.

Want more smart ways to manage your money?

👉 Discover smarter ways to invest and grow your portfolio! Visit GetCashVibe today for more expert tips.