Introduction

Let’s face it—building credit can feel like trying to win a game where you don’t know the rules. If you’re starting from scratch or trying to rebuild after financial setbacks, one tool that’s gained attention is the credit builder account. But how does a credit builder work, and more importantly—is Self worth it?

With today’s economy putting pressure on young adults, freelancers, and middle-income earners, maintaining a healthy credit score isn’t just a goal—it’s a necessity. This guide breaks down exactly how the Self Credit Builder Account works, its pros and cons, and how to decide if it’s the right financial move for you.

What Is a Credit Builder Account? Credit builder work

A credit builder account is a type of installment loan designed not to give you money upfront, but to help you build or rebuild your credit. It works differently from traditional loans:

- You don’t receive money right away. Instead, the loan amount is held in a secure account.

- You make monthly payments toward the loan. These payments are reported to the credit bureaus.

- Once the loan is fully paid off, you receive the money (minus fees and interest).

Essentially, it’s a savings plan that helps boost your credit score if you stay consistent.

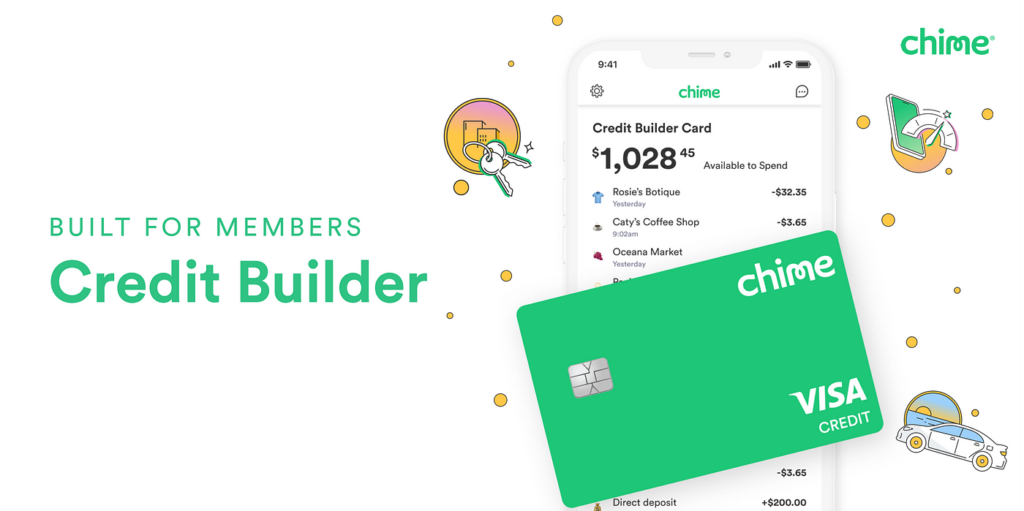

How Does the Self Credit Builder Work?

Self, also known as Self Financial, is one of the most popular credit builder services on the market. Here’s a step-by-step look at how their account works:

Step 1: Apply Online

You can sign up through Self’s website or app with no credit check. This makes it ideal for people with thin or poor credit files.

Step 2: Choose a Plan

Self offers four plans ranging from $25 to $150 per month. Each plan lasts 12 to 24 months and comes with a set interest rate and administrative fee.

| Plan | Monthly Payment | Term Length | Total Cost | Payout After Term |

|---|---|---|---|---|

| Basic | $25 | 24 months | ~$600 | ~$520 |

| Standard | $35 | 24 months | ~$850 | ~$700 |

| Premium | $48 | 12 months | ~$575 | ~$520 |

| Max | $150 | 12 months | ~$1,800 | ~$1,650 |

Note: These values may vary; always confirm current rates on Self’s official site.

Step 3: Make Payments Monthly credit builder work

Each payment is reported to all three credit bureaus (Experian, Equifax, TransUnion), which is crucial for building a strong credit history.

Step 4: Receive Funds at End credit builder work

Once the term ends, you’ll receive the saved amount, minus any applicable fees.

Is Self Worth It? credit builder work

Let’s break down the pros and cons to help you decide.

✅ Benefits

- No hard credit check: Won’t hurt your score to apply.

- Credit reporting to all bureaus: Essential for effective credit-building.

- Mobile app and reminders: Helps build positive habits.

- Flexible plans: Accessible to a range of budgets.

- Builds payment history: The most important factor in credit scoring.

❌ Drawbacks

- You don’t get money upfront: This isn’t a loan you can use immediately.

- Fees and interest apply: You’ll pay more than you receive.

- Missed payments can hurt your score: Just like a regular loan.

When Self Might Be Worth It:

- You’re just starting out with little or no credit.

- You’re recovering from bad credit and need positive history.

- You struggle with saving consistently.

When It Might Not Be Right:

- You’re looking for immediate access to funds.

- You’re already managing other forms of credit well.

- You have trouble keeping up with fixed monthly payments.

Actionable Tips to Maximize Results credit builder work

If you decide to go with Self, here’s how to make the most of it:

- Set Auto-Pay: Avoid missing payments and late fees.

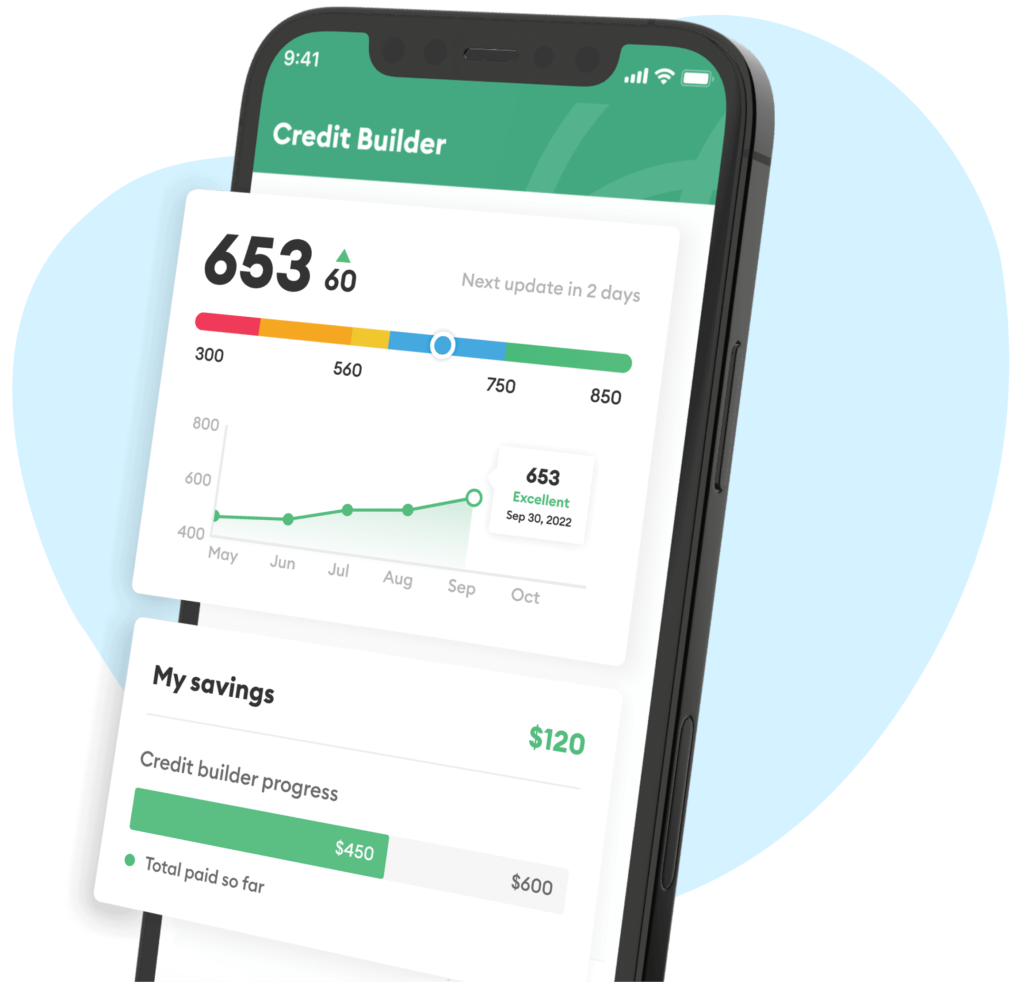

- Monitor Your Credit Score: Use tools like Credit Karma to track changes monthly.

- Keep Credit Utilization Low: Pair the builder account with a secured card if possible.

- Graduate to Better Products: After 6–12 months of positive history, consider applying for unsecured credit or refinancing.

Internal Resource: credit builder work

Interested in other beginner-friendly investing tools? Check out our guide on Top Investment Alternatives to REITs.

FAQs

How long does it take to see credit improvement with Self?

Most users report a credit score increase within 3–6 months, depending on their starting point and other credit activity.

Can I cancel my Self account early?

Yes, but you’ll receive only the amount you’ve paid in, minus fees. This may also limit the credit-building benefits.

Does Self guarantee a credit score increase?

No, but on-time payments reported monthly to all three bureaus give you the best shot at improvement.

Will opening a Self account hurt my credit?

No. There’s no hard inquiry when you apply.

Can I open more than one credit builder account?

It’s not recommended to open multiple at once, as it may complicate your payment schedule and increase risk of default.

Conclusion

A credit builder account like Self can be a powerful stepping stone if you’re starting your credit journey or working your way back from a low score. While it comes with costs, the long-term benefits—like easier loan approvals and better interest rates—can far outweigh the initial fees if used wisely.

So, is Self worth it? For many, the answer is yes—if you stick to the plan. It’s not a magic fix, but it’s a smart strategy when paired with responsible financial habits.

Ready to build better credit?

Discover smarter ways to invest and grow your financial future. Visit GetCashVibe today for more expert tips.