In 2025, your credit score is more than just a number — it’s your financial passport. Whether you’re applying for a mortgage, leasing a car, or even renting an apartment, a good score can save you thousands. If you’re looking to improve your credit without diving into complex financial products, credit building apps in 2025 offer a smart, simple solution.

In this guide, we’ll explore the top credit building apps for 2025, break down how they work, and help you choose the right one for your goals.

Why Credit Building Apps Matter in 2025

The financial world is shifting. Traditional credit-building methods—like secured credit cards and personal loans—are still around, but they’re not always beginner-friendly. The best credit building apps in 2025 bridge that gap by combining technology, automation, and ease-of-use.

They’re designed for:

- Young adults building credit for the first time

- Freelancers or gig workers without traditional income

- Debt recovery users looking to rebuild after financial hardship

What to Look for in a Credit Building App

Before we dive into the list, here’s what separates a great app from the rest:

- Reports to all three credit bureaus (Experian, Equifax, TransUnion)

- Low or no fees

- No credit check required to sign up

- Clear progress tracking

- Extra tools like budgeting, alerts, or rent reporting

Top Credit Building Apps for 2025

Here’s our curated list of the best apps to help you build or rebuild your credit in 2025. Each offers unique features to suit different financial needs.

1. Self – Credit Builder Account

Self remains a top choice in 2025 due to its proven track record and transparency.

Key Features:

- Creates a credit builder loan that you repay monthly

- Reports to all three bureaus

- Funds released at the end of the term (like a savings plan)

- No credit check to get started

Best For: Beginners and people with no credit history.

👉 Read our full review on Self (Best Credit-Building Apps to Boost Your Score in 2025)

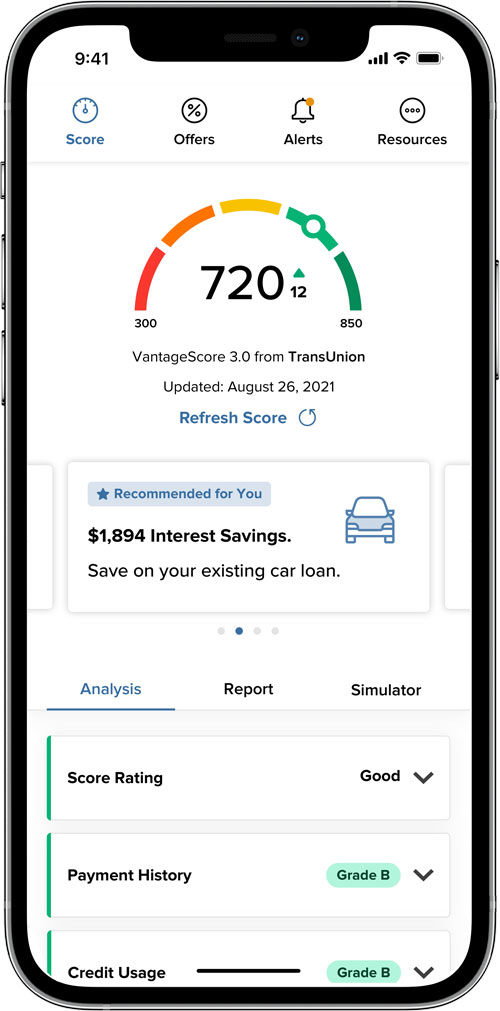

2. Experian Boost

Unlike other apps, Experian Boost helps you instantly improve your credit score by using bills you’re already paying.

Key Features:

- Adds payments for Netflix, utilities, and phone bills to your credit file

- Completely free

- Real-time results

Best For: Those with thin credit files or near-prime scores.

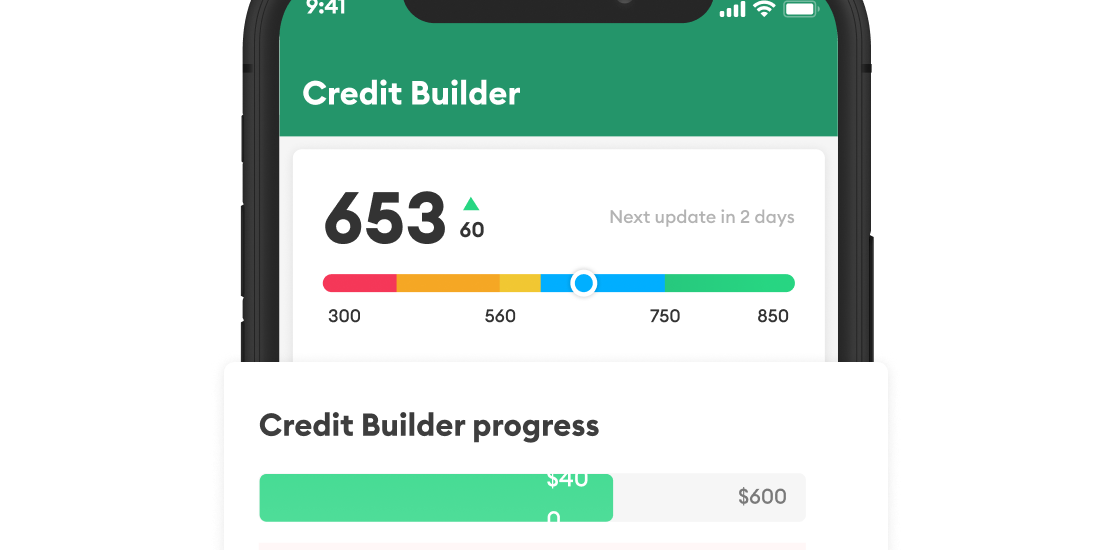

3. Chime Credit Builder

Chime’s secured credit card works like a charm — without charging interest or fees.

Key Features:

- No interest, no annual fees

- No credit check required

- Requires a Chime Spending Account

Best For: People who want more control over their credit limit and avoid debt.

4. Grow Credit

Grow Credit lets you build credit by paying for subscriptions like Spotify or Hulu.

Key Features:

- Offers free and premium plans

- Reports to all major bureaus

- Helps manage spending habits

Best For: Budget-conscious users and subscription lovers.

5. Kikoff

Kikoff offers an innovative way to improve your credit score through micro-loans.

Key Features:

- $750 revolving credit line

- 0% interest, no fees

- Helps build payment history and utilization

Best For: Users with poor credit looking for a fast boost.

How to Use These Apps Effectively credit building apps 2025

Here’s how to get the most from your credit-building app:

- Stay consistent. Make every payment on time — even if it’s small.

- Track your progress. Monitor your score monthly.

- Avoid stacking multiple apps. Too many new accounts can hurt your score.

- Review credit reports regularly. Dispute any errors that may pop up.

Internal Resources for You

Looking for more smart financial moves? Explore:

FAQs About Credit Building Apps (2025)

What’s the fastest credit building app in 2025?

Apps like Experian Boost show instant results, while Kikoff and Self work best over a few months.

Can these apps hurt my credit?

No — most don’t require hard inquiries. But missed payments will negatively impact your score.

How long does it take to see results?

Many users notice changes in 1–3 months, but consistent usage over 6–12 months yields stronger improvements.

Are credit builder apps safe to use?

Yes, especially if they are FDIC-insured, use encryption, and report to major bureaus.

Conclusion: Build Credit Smarter, Not Harder

In 2025, credit building doesn’t have to be intimidating. With the right app, you can automate your progress, gain financial confidence, and unlock better loan terms in the future. Whether you’re starting from scratch or rebuilding after a setback, there’s an app designed to meet you where you are.

Discover smarter ways to invest and grow your portfolio! Visit GetCashVibe today for more expert tips.