Introduction: Credit Boosting Apps Are Your Secret Weapon in 2025

Your credit score isn’t just a number—it’s your financial reputation. Whether you’re applying for a mortgage, financing a car, or even renting an apartment, your credit score plays a crucial role. In 2025, one of the most efficient and user-friendly ways to boost your credit score is by using credit boosting apps.

These apps are designed to simplify the credit-building process, often reporting positive financial behavior like on-time payments or subscription bills directly to credit bureaus. If you’re just starting your credit journey, trying to recover from debt, or simply aiming to hit a higher score bracket, the right app can give you that extra edge—instantly.

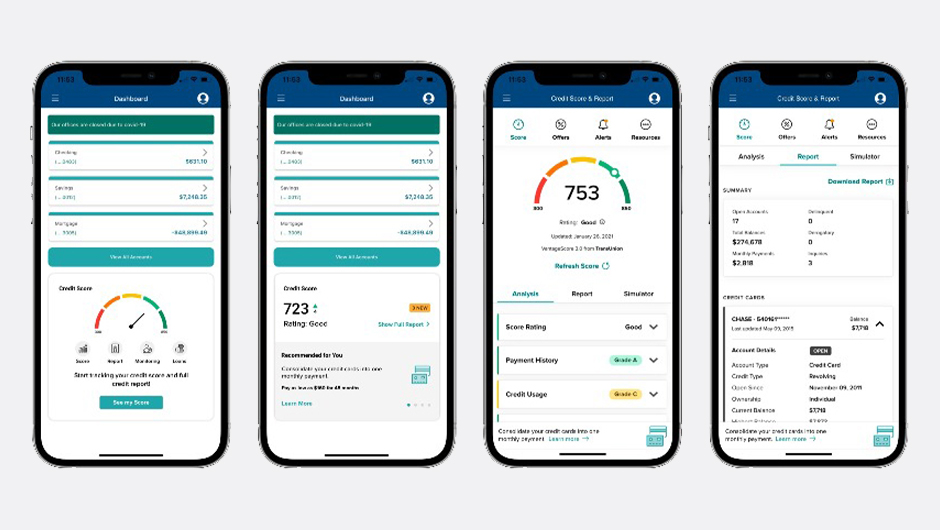

What Are Credit Boosting Apps?

Credit boosting apps are financial tools that help you improve your credit score by reporting specific payment activities to one or more of the major credit bureaus (Experian, Equifax, and TransUnion). Unlike traditional credit-building methods, these apps often leverage everyday payments—like rent, utilities, and subscriptions—to give your credit profile a much-needed lift.

The 9 Best Credit Boosting Apps in 2025

Here’s a breakdown of the top credit boosting apps this year, based on their features, ease of use, cost, and impact.

1. Experian Boost

Best For: Quick, no-cost score increase

How It Works: Links to your bank account and scans for utility, rent, and subscription payments to add to your Experian credit file.

✅ Pros:

- Free to use

- Immediate score updates

- No risk of score damage

❌ Cons:

- Only affects your Experian report

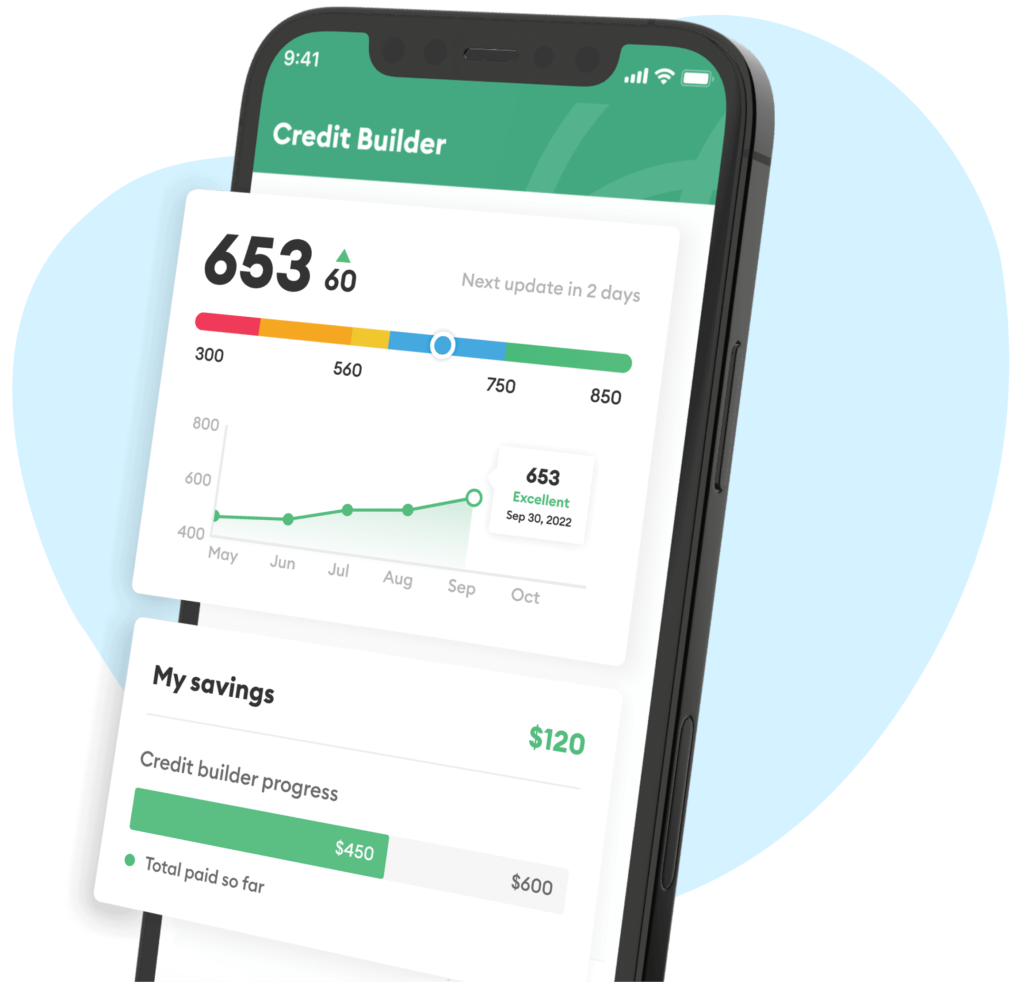

2. Self

Best For: Building payment history with savings

How It Works: Offers a credit builder loan you repay monthly. The payments are reported to all three credit bureaus.

✅ Pros:

- Builds both savings and credit

- Can lead to a secured credit card

❌ Cons:

- Monthly commitment required

📚 Read more: Self Credit Builder Explained

3. Grow Credit

Best For: Building credit via subscriptions

How It Works: Issues a virtual Mastercard to pay recurring bills like Netflix or Spotify, reporting them as credit payments.

✅ Pros:

- Works with minimal spending

- No credit check

❌ Cons:

- Only covers subscriptions

4. CreditStrong

Best For: Long-term credit growth

How It Works: Offers credit builder loans with various term lengths and payments reported monthly.

✅ Pros:

- Reports to all major bureaus

- Flexible loan terms

❌ Cons:

- Slightly higher monthly cost than Self

5. Chime Credit Builder Card

Best For: Fee-free secured credit usage

How It Works: A secured card without fees, deposits, or interest. You preload money and use it like a debit card—with activity reported to bureaus.

✅ Pros:

- No fees or interest

- Great for daily spending

❌ Cons:

- Requires a Chime Spending Account

6. Kikoff

Best For: Super low-cost credit building

How It Works: Offers a $750 revolving line of credit, mainly for small digital purchases.

✅ Pros:

- Only $5/month

- No credit check

❌ Cons:

- Limited to Kikoff’s marketplace

7. MoCaFi

Best For: Rent reporting for underserved communities

How It Works: Reports rent payments to Equifax. Also offers free financial coaching.

✅ Pros:

- No credit check

- Designed for underserved groups

❌ Cons:

- Only reports to one bureau

8. Brigit

Best For: Managing finances while boosting credit

How It Works: Offers credit monitoring, cash advances, and automatic overdraft protection while reporting payments.

✅ Pros:

- Multiple tools in one app

- Personalized insights

❌ Cons:

- Monthly subscription required

9. Perch Credit (if relaunched in 2025)

Best For: Reporting rent and subscriptions

How It Works: Users link accounts for rent and media services to report consistent payments.

✅ Pros:

- Targets Gen Z users

- Helps with thin credit files

❌ Cons:

- App updates may vary depending on relaunch status

Tips to Get the Most Out of Credit Boosting Apps

Here are some actionable strategies to maximize your results:

- Automate payments: Never miss a due date—set up auto-pay where possible.

- Use multiple methods: Combine a credit builder loan with a rent reporting app.

- Monitor your score monthly: Track changes and note what behaviors move the needle.

- Start early: The longer your positive history, the better your score.

FAQs About Credit Boosting Apps

Q1: Can these apps guarantee a credit score increase?

No app can guarantee results, but consistent use and on-time payments usually lead to noticeable improvements.

Q2: Are there free credit boosting apps?

Yes, Experian Boost, Grow Credit (basic plan), and Kikoff offer free or very low-cost options.

Q3: How long before I see results?

Many users see score changes within 30–90 days of starting, depending on the app and their credit profile.

Q4: Do I need a credit card to use these apps?

Not always. Apps like Self, Grow Credit, and MoCaFi are designed specifically for users without traditional credit cards.

Final Thoughts: Start Boosting Your Credit the Smart Way

With so many credit boosting apps available in 2025, there’s truly no reason to let your credit score hold you back. These tools are practical, budget-friendly, and often require little more than the bills you’re already paying. Whether you’re recovering from past mistakes or just getting started, these apps offer a real chance to build a better financial future.

Take the first step today.

Explore smarter credit strategies and personal finance tips—only at GetCashVibe.